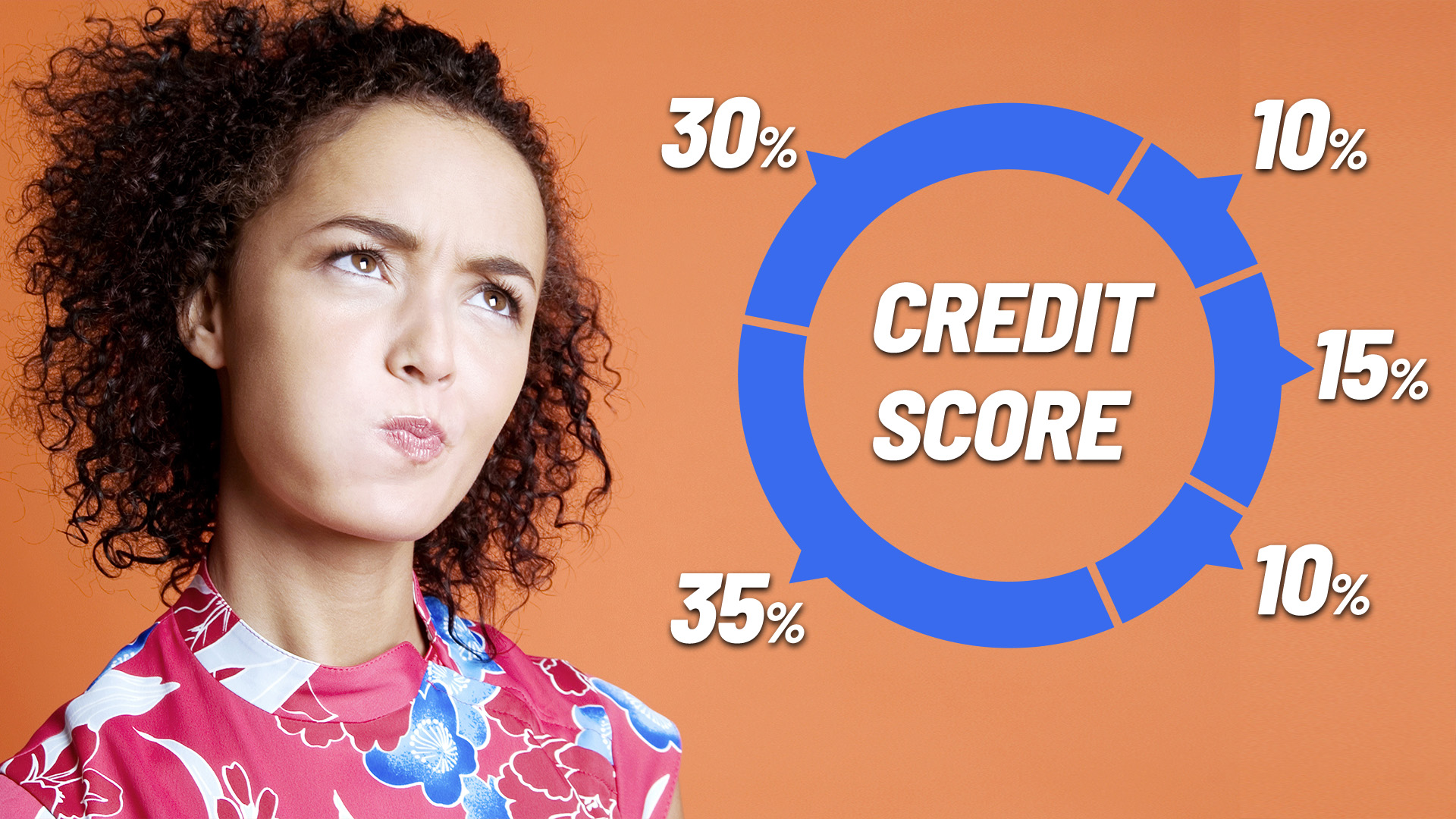

Credit Score calculations can feel confusing and intimidating. However, it really comes down to just five main factors that credit scores are calculated from. It can be much simpler to improve your credit score by focusing on ways to improve in these five areas. Despite there being a variety of methods that are used to calculate credit scores, the most common and most significant factors are described below:

1. Your Payment History

Payment history is one of the most important factors in credit scoring, and even a single missed payment can have a negative impact on your score. The higher your credit score, the better rates you are likely to get on loans and mortgages. A good credit score is around 700. You can improve your credit score by paying your bills on time and avoiding costly credit card debts and other loans that you may not be able to pay back. A poor payment history can lower your credit score, which could make it harder to obtain a loan or get a better interest rate on a mortgage. Lenders want to be sure you will be able to pay back your debt, and on time. 35% of your FICO Score is based on this factor.

2. Your Credit Utilization Ratio

Your credit utilization ratio is the percentage of your available credit that you are using. A high credit utilization ratio can indicate that you are spending more than you are able to borrow, which can lead to financial difficulties. A low credit utilization ratio can indicate that you are using your available credit responsibly and have a good history of paying your bills on time.

Your credit utilization ratio is the percentage of your total revolving credit you are currently using. This number can be used to see how reliant you are on non-cash funds. Using more than 30% of your available credit is considered a negative for creditors, which may impact your ability to get approved for future loans. 30% of your FICO Score is based on this factor.

3. Your Credit History Length

Credit history length is the next factor that affects your credit score. The longer your credit history, the better your credit score will be. Having a longer credit history simply provides a greater and more reliable foundation of data for lenders to base their decision to lend or not to lend. Your credit history makes up 15% of your FICO Score.

4. Your Credit Mix

Your credit mix includes the types of loans and credit accounts you have open. People with good credit scores often have a diverse portfolio of credit accounts, which might include a car loan, credit card, student loan, mortgage or other types of loans. Credit scoring models consider the types of accounts and how many of each you have as an indication of your ability to manage a variety of loans.

5. New Credit Accounts

The number of credit accounts you've recently opened, as well as the number of hard inquiries lenders make when you apply for credit, can impact your FICO Score by 10%. Too many accounts or inquiries can indicate increased risk, and could lead to negative consequences like a lowered credit score.

Now that you know what factors are taken into consideration, you can take steps towards improving in these 5 areas.